Overview

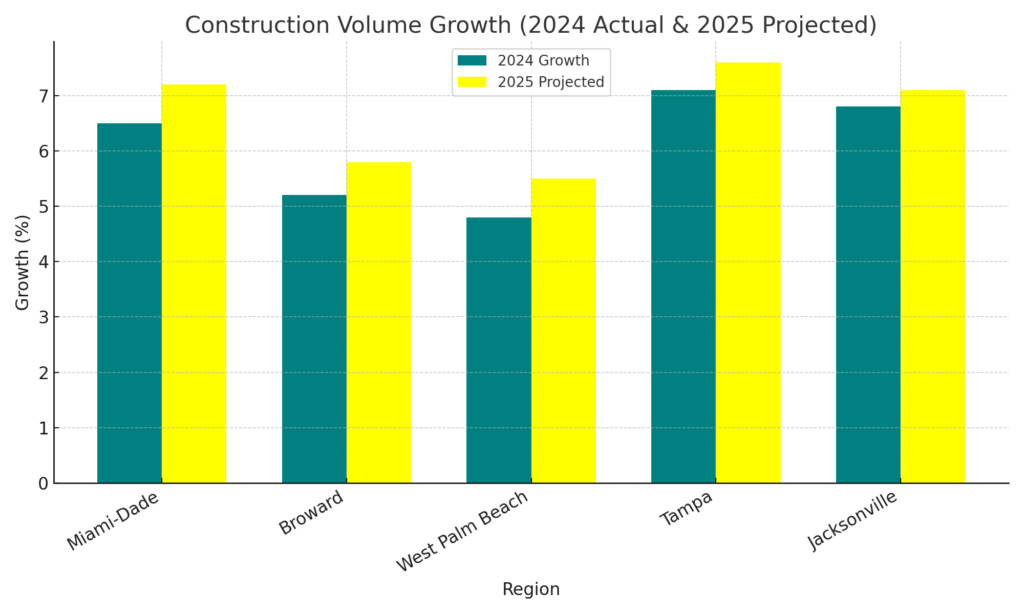

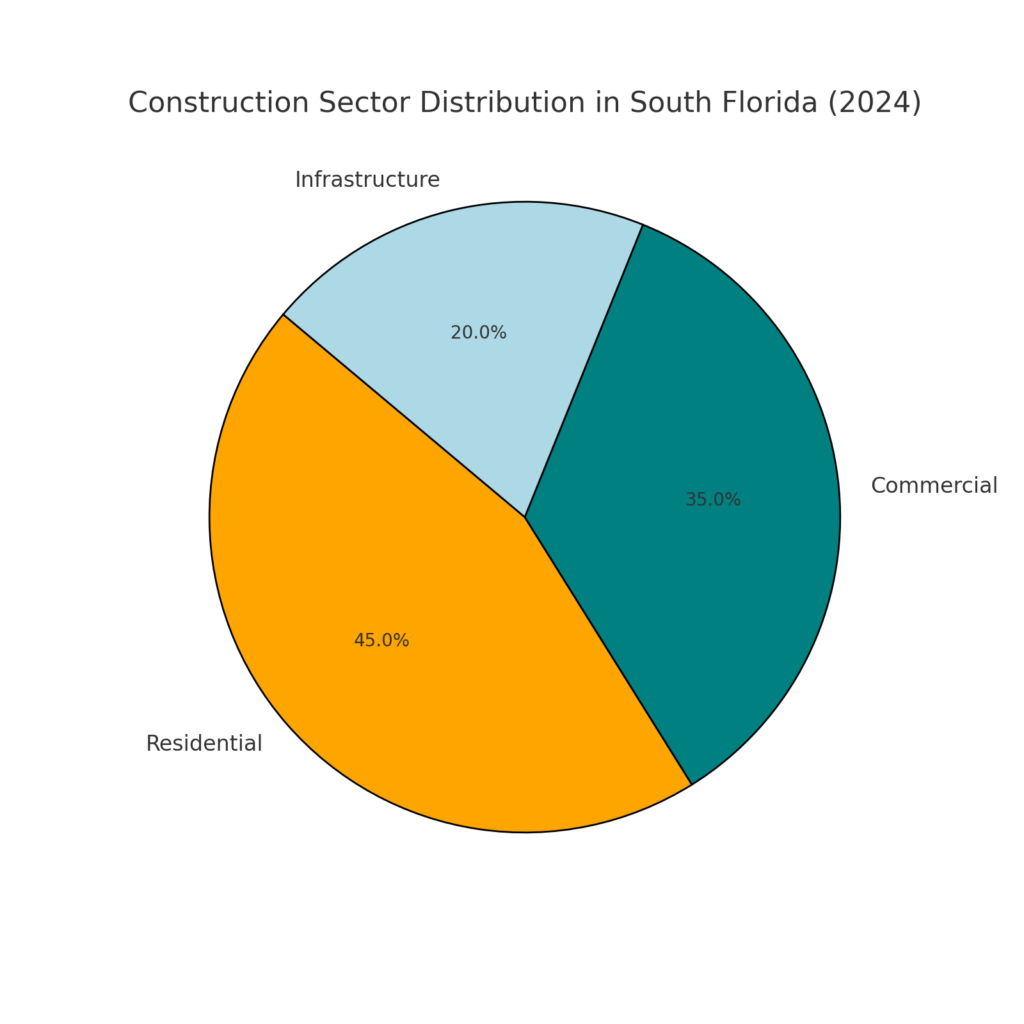

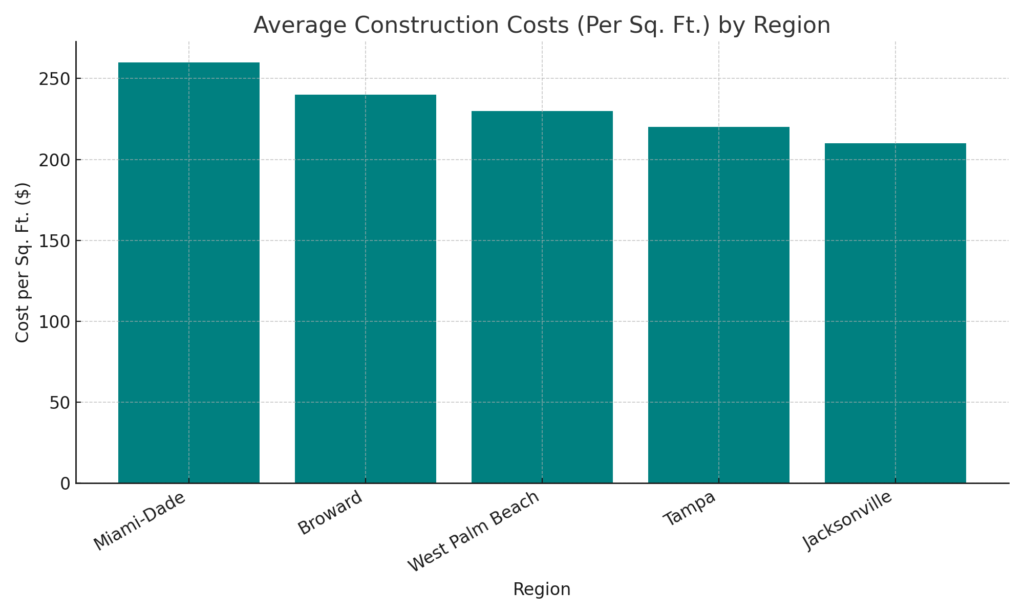

The construction industry in the United States saw significant growth in 2024, driven by infrastructure investments, housing demands, and commercial real estate developments. South Florida remains a key region with high activity across Miami-Dade, Broward, West Palm Beach, Tampa, and Jacksonville. Looking ahead to 2025, projections indicate continued expansion influenced by recent political and economic conditions.

2024 Actual Growth

Miami-Dade County

Residential Construction

Miami-Dade experienced a 6.5% growth in residential construction, particularly in multifamily developments driven by increasing urban demand.

Projected Growth Rate

6.5% YoY.

Luxury Market

High-end residential projects surged, with waterfront condominiums in high demand.

Commercial Construction

The sector grew by 5.8%, led by hospitality and retail developments.

Key Projects

Miami Worldcenter phases and new luxury hotels.

Broward County

Residential Construction

Growth reached 5.2%, with a rise in suburban single-family home developments.

Projected Growth Rate

5.2% YoY

Infrastructure

Investments in road expansions and public transit improvements,

including Fort Lauderdale airport expansion.

West Palm Beach

Luxury Market

Palm Beach County recorded over 13,300 single-family home sales and 9,900 condo transactions, with ultra-luxury properties exceeding $10 million in high demand.

Projected Growth Rate

4.8% YoY.

Key Drivers

Influx of high-net-worth individuals.

Green Initiatives

Increased focus on energy-efficient buildings

and sustainability projects.

Tampa Bay Area

Commercial Boom

trong growth in logistics, warehouses, and office spaces, contributing to a 7.1% increase in commercial developments.

Projected Growth Rate

7.1% YoY.

Major Developments

Water Street Tampa (ongoing phases).

Residential Trends

High demand for affordable housing in suburban areas.

Jacksonville

Industrial Construction

A 6.8% increase in industrial development, largely driven by port activities and logistics expansion.

Projected Growth Rate

6.8% YoY.

Mixed-Use Developments

Urban revitalization projects, such as

The District – Life Well Lived.

2025 Projected Growth

Residential and Commercial Construction

Cities like Miami and Tampa-St. Petersburg are projected to be among the top housing markets in 2025, driven by affordability, population growth, and economic stability.

Infrastructure Developments

Miami-Dade County’s North Corridor Metrorail extension is expected to boost property values and urban development.

Luxury Market

Continued expansion in West Palm Beach, especially in high-end residential projects.

Industrial Growth

Jacksonville’s port-related activities will keep industrial construction on an upward trajectory.

Trends Influencing the South Florida Market

Population Growth

Florida’s population increased by 1.7% in 2024, fueling housing demand.

Tourism and Hospitality

Record-breaking tourism continues to drive hotel and entertainment construction.

Sustainability

Developers are prioritizing green-certified and energy-efficient designs.

Economic and Political Factors

Pro-development policies and infrastructure funding initiatives support continued industry growth in 2025.

Key Challenges

Affordability

Rising housing costs may limit market accessibility for some buyers.

Regulatory Hurdles

Complex permitting processes could slow project approvals.

Climate Risks

Flooding and hurricane threats necessitate resilient building strategies.

Charts and Visualizations

Construction Volume Growth (2024 Actual & 2025 Projected)

Construction Sector Distribution in South Florida (2024)

Construction Sector Distribution in South Florida (2024)

Sources

-

Dodge Data & Analytics: Regional construction projections.

-

U.S. Census Bureau: Population and housing statistics.

-

Florida Department of Economic Opportunity: Labor market trends.

-

Local Planning Authorities: Regional development projects.

-

New York Post Real Estate Reports: Luxury market insights.

-

Brightline Expansion Impact Studies: Effects on property values.

Disclaimer

This document is intended for informational purposes only and does not constitute investment advice. The information contained herein is based on sources believed to be reliable; however, accuracy and completeness cannot be guaranteed. Readers should conduct their own research or consult with a financial advisor before making investment decisions.

Privacy Policy

This report and its contents are proprietary. Unauthorized reproduction or distribution of this material is prohibited. By accessing this document, you agree not to distribute, modify, or reproduce its content without prior written permission. Any data shared herein will be used solely for informational purposes and in compliance with applicable privacy laws.